Essential Estate Planning Documents and Why Avoiding Probate Matters

- Marc Lowe

- Apr 29, 2025

- 4 min read

Updated: May 16, 2025

When people hear "estate planning," they often think it's only for the wealthy. But that’s a myth—and potentially a costly one. Estate planning is about making sure your wishes are honored: who inherits your property, who manages your finances, and who makes medical decisions for you if you’re unable to.

Let’s break down the essential documents you need and explain how probate avoidance can benefit you and your loved ones.

Why Estate Planning Matters for Everyone

Ask yourself:

Who do you want to inherit your property?

Who should handle your financial matters if you're incapacitated—or after you pass?

Who should make medical decisions for you if you can’t?

Have you clearly communicated your end-of-life wishes?

If you don’t have a plan, the state does. Through the law of intestate succession, state law decides who gets your property. The court can appoint guardians and administrators to make decisions on your behalf. The result? More cost, time, and potential stress for your loved ones.

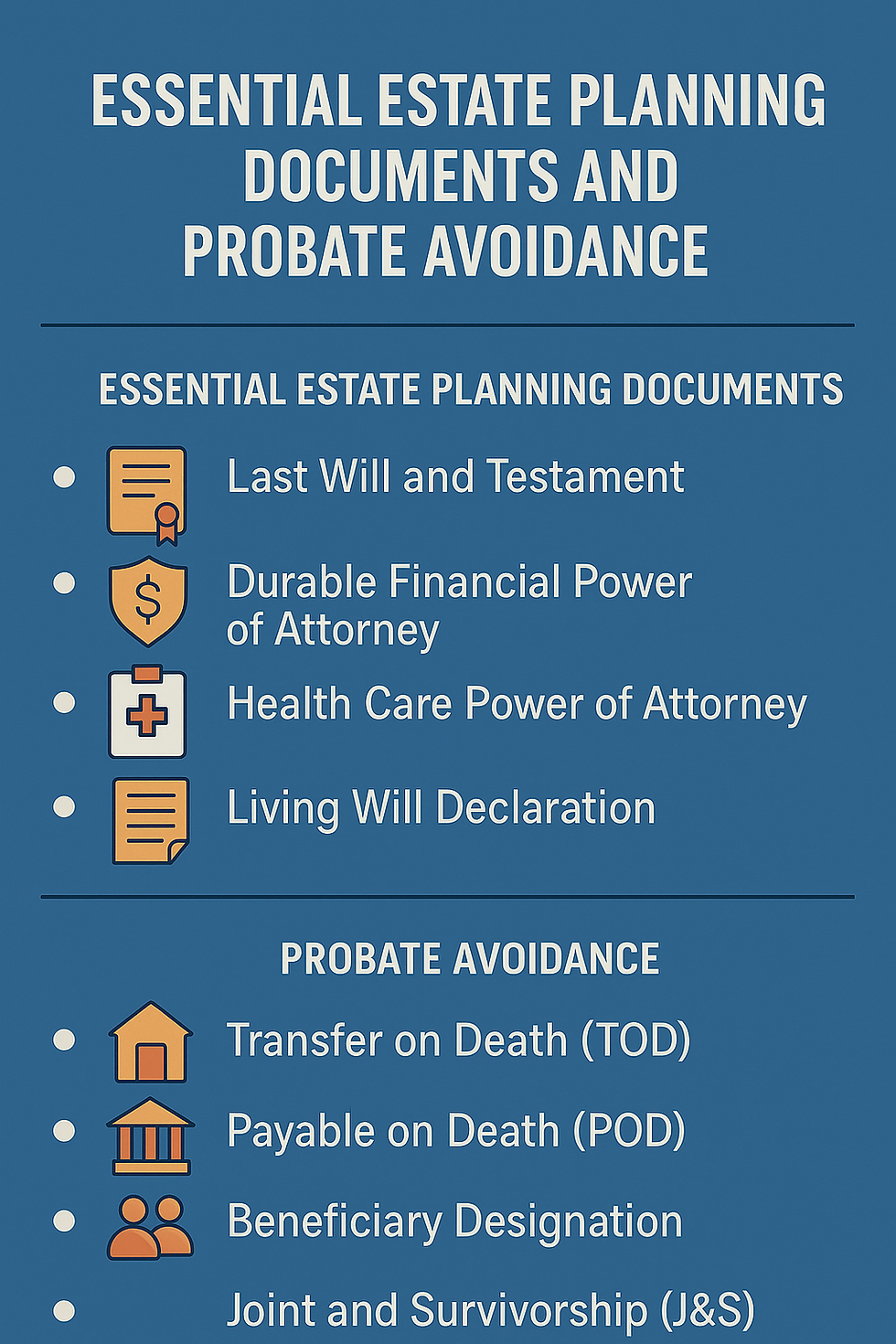

The “Core Four” Estate Planning Documents

Here are the four key legal documents that put you in control:

Last Will and Testament This document determines who inherits your assets and who will handle your final affairs as your executor. If you don’t name someone, the court will.

Durable Financial Power of Attorney This lets you appoint someone to manage your financial affairs if you're incapacitated. Without it, your family may need to go to court to request guardianship, which is time-consuming and expensive.

Health Care Power of Attorney Similar to the financial power of attorney, this designates a trusted person to make medical decisions if you can’t. It’s your voice when you can’t speak.

Living Will Declaration This outlines your wishes for end-of-life care, such as whether you want life-sustaining treatments or artificial nutrition. It also allows you to specify who should be notified.

Understanding Probate—and Why You Might Want to Avoid It

Probate is the legal process of transferring your assets after death. It involves court-appointed executors, inventorying assets, filing accountings, and sometimes posting bonds.

While probate isn’t inherently bad—and can be helpful in complex situations—many people choose to avoid it because:

It can be costly

It can be time-consuming

It becomes public record

It adds unnecessary complexity for survivors

Easy Ways to Avoid Probate Without a Trust

You don't need a complex trust to avoid probate. Here are some common and effective tools:

Transfer on Death (TOD): Common for real estate, stocks, bonds, and even vehicles. Ownership transfers automatically when you pass away.

Payable on Death (POD): Used for bank accounts. You retain control during your lifetime, and the account passes directly to your beneficiary after death.

Beneficiary Designations: Used for retirement accounts, life insurance, and annuities. You simply name who receives the asset.

Joint and Survivorship (J&S): Assets like real estate or bank accounts can be jointly owned, with automatic transfer to the surviving owner.

These tools are fast, affordable, and simple—but they aren’t perfect for every situation.

The Drawbacks of Probate Avoidance Tools

While TOD, POD, BD, and J&S can be useful, they have some limitations:

There’s no oversight—if beneficiaries don’t get along or are financially irresponsible, it can cause problems.

It can be hard to coordinate multiple beneficiaries or unequal percentage splits.

Real estate owned jointly can create title and dower issues.

With no central executor, no one is “in charge” of the big picture.

In these cases, a revocable living trust or a carefully structured estate plan might be a better solution.

Coming Up Next: Why Consider a Revocable Living Trust? In our next article, we’ll explore the power of revocable living trusts—what they are, how they work, and why they may offer a more comprehensive solution for managing and distributing your assets, especially for more complex or high-value estates.

Final Thoughts: Take Control Today

Estate planning isn’t about how much you have—it’s about what happens when you’re gone or unable to act for yourself. Whether your estate is simple or complex, having the right documents in place can save your loved ones stress, confusion, and expense.

Working with a qualified financial planner and estate attorney can help ensure your plan reflects your goals—and avoids unnecessary complications down the line.

About The Author

Marc Lowe is Founder of In The Money Retirement Planning. He is a Certified Financial Planner and member of NAPFA National Association of Personal Financial Advisors, XY Planning Network & Fee-Only Network. He works with retirees and those approaching retirement. He has over a decade of experience helping these folks grow their net worth, organize their finances and build better lives for themselves and their families.

The information presented in this Presentation is the opinion of the author and does not reflect the views of any other person or entity unless specified. The information provided is believed to be reliable and obtained from reliable sources, but no liability is accepted for inaccuracies. The information provided is for informational purposes and should not be construed as advice. Advisory services offered through In The Money Retirement, an investment adviser registered with the state of Connecticut.

Comments